capital gains tax news canada

But if were talking about a 25 increase in the capital gains tax Id say sell now while you have the chance. Canadian Capital Gains Tax of Investment Properties.

Can Capital Gains Push Me Into A Higher Tax Bracket

And the tax rate depends on your income.

. Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen. In Canada the capital gains inclusion rate is 50. Capital Gains Tax Rate.

In other words for every 100 of capital gains generated on a sale or a disposition there is an additional 1338 of tax owed. The capital gains tax rate in Ontario for the highest income bracket is 2676. Conservative Leader Erin OToole is accusing the Liberals of planning to impose a capital gains tax on people who sell their homes but Justin Trudeau says its not true.

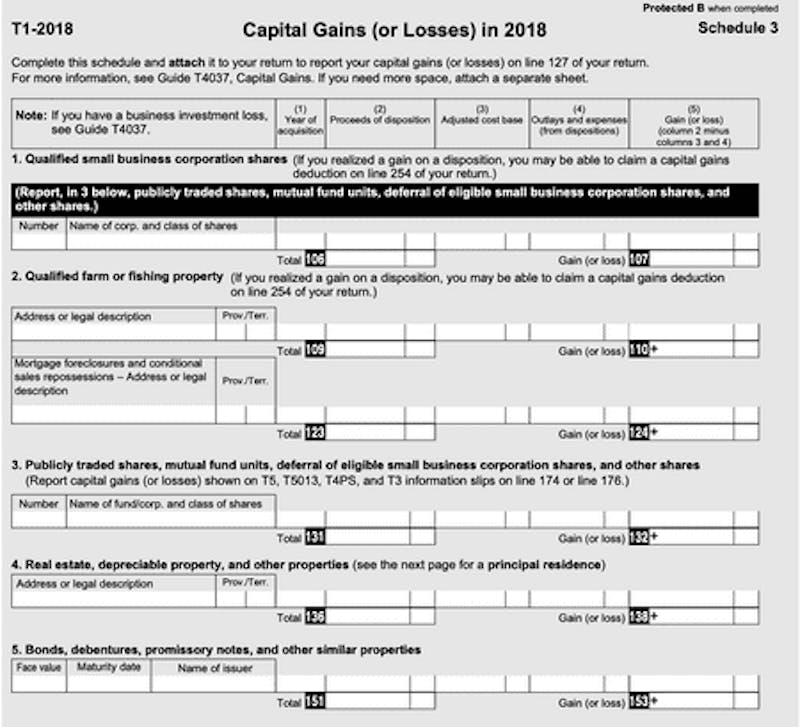

Canada Capital Gains Tax on Investment Properties. Up to 20 cash back To claim a capital loss I have to give the capital gains inclusion rate for the year 2000 if I want to claim the loss on this years tax return. In addition the Income Tax Act ITA prohibits undertaxing wages earned over 20000 by individuals.

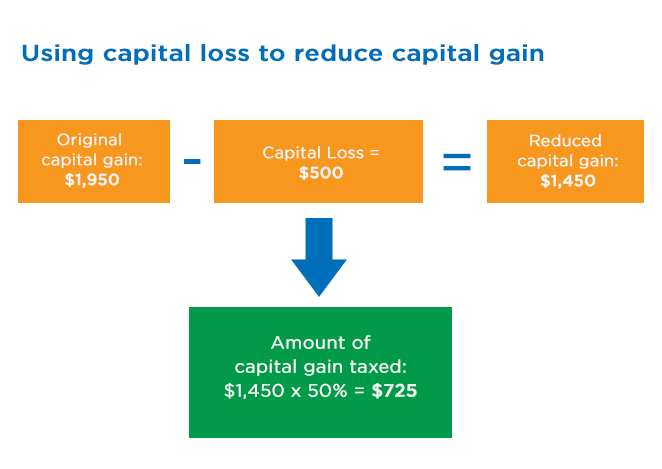

When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Pay the 50 on your gains then reinvest your money in. Capital gains are taxed at 50 in the case of corporate income because investment gains are taxed at only 50.

Including a higher capital gains tax could be in Canada. Next lets compare how capital gains tax is applied to investment properties for the US. Remember you may qualify for a 250000 capital-gains exclusion 500000 if you were married if this has been your main home two out.

Budget 2022 proposes to reduce the business limit by 1 for every 80 of taxable capital in excess of 10 million such that the limit will be more gradually reduced and only eliminated where taxable capital equals or exceeds 50 million. Capital gains taxes Canada Discussion on Cryptocurrency Forums Cryptocurrency Discussion This topic has 3 replies 1 voice and was last updated 1 hour 36 minutes ago by Jxntb733. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. You must pay taxes on 50 of this gain at your marginal tax rate. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market.

But in Canada today only 50 per cent of realized capital gains are included in taxable income meaning the effective personal tax rate on these gains is only half that of other income. For the illustration above we have ignored the calculation of recapture of. In case you sell the investments at a higher price than you paid for them realized capital gain half of the capital gain will need to be added to your income in order to qualify for tax benefits.

Under the Canada Income Tax Act you only have to pay tax on 50 of the profits as capital gain tax to the CRA. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. An examination of the taxation of capital gains in Canada suggests that this objective would be better achieved with a reduction in the inclusion rate of capital gains The Chrétien and Martin Liberals reduced the capital gains inclusion rate the amount of capital gains subject to tax from 75 to 50 as part of a larger initiative to improve Canadas.

At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. NDPs proto-platform calls for levying. Business analyst Paul Martin said he anticipates fewer.

In Canada 50 of the value of any capital gains are taxable. That is 21 years ago and I dont have that record. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

It says it is on line 16 schedule 3 for the 2000 tax return. Truth Tracker Richard. None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of.

Canadas tax code allows dividends payable by corporations to be deducted under s. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. In 1985 the government introduced a capital gains exemption where each Canadian did not have to pay any tax on capital gains up.

Canada has a tax on capital gains of 50. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. Canada Tax Capital Gains Tax Corporate Tax Income Tax.

As previously argued here at Finances of the Nation the current system is inequitable because capital gains income is unequally distributed. Even on the CRA my account site it only goes back 11 years. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Yes there was. Red Flags For Tax Audits. For example on a capital gain of 10000 half of that or 5000 would be taxed based on.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Capital Gains Tax Capital Gain Integrity

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Reporting Capital Gains Dividend Income Is Complex Morningstar

The Ultimate Canada Crypto Tax Guide 2022 Koinly

How To Calculate Capital Gains Tax Canada Ictsd Org

Reporting Capital Gains Dividend Income Is Complex Morningstar

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax Calculator For Relative Value Investing

How To Avoid The Capital Gains Tax Loans Canada

Did You Know A Non Resident Corporation Is Subject To Canadian Income Tax On Taxable Capital Gains Realized On The Disposition O Tax Consulting Income Tax Tax

Capital Gains Tax Calculator For Relative Value Investing

How To Calculate Capital Gains Tax Canada Ictsd Org

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know